Claims are arguably the most important aspect of insurance for customers. When a loss occurs, the customer expects to receive compensation as quickly as possible. For minor and straightforward claims, the process may be automated, allowing the customer to receive the insurance payout very quickly.

The claims process and the scope of services depend on the type of insurance and the policy in question. In general, claims handling in life assurance is simpler than in non-life insurance. In life assurance, the process may be as straightforward as the insurance company paying the death benefit to the beneficiary in accordance with the terms and conditions of the contract.

The processing of non-life insurance claims is often more complex. In water or fire damages, for example, the insurer may first carry out a damage inspection or obtain additional information for example by commissioning a loss assessor to investigate the cause and extent of the damage.

Safety and protection instructions

Insurance companies pay out approximately €9 billion in compensation annually. Losses result in significant costs for individuals and society. To prevent damage, insurance companies issue protection guidelines for both individuals and businesses. These guidelines aim to reduce the insured party’s contribution to the occurrence of damage by instructing them to act – or refrain from acting – in certain ways.

Compliance with protection guidelines helps prevent damage. The policyholder, the insured person and any comparable party must follow the insurer’s guidelines. If the guidelines are neglected and this negligence contributes to the occurrence of damage, the failure to comply may lead to a reduction in the insurance payout or, in extreme cases, denial of compensation.

Protection guidelines may concern equipment (e.g. locks and burglar alarms), procedures (e.g. fire safety practices), or personnel qualifications (e.g. guarding and cash-in-transit operations).

Filing an insurance claim

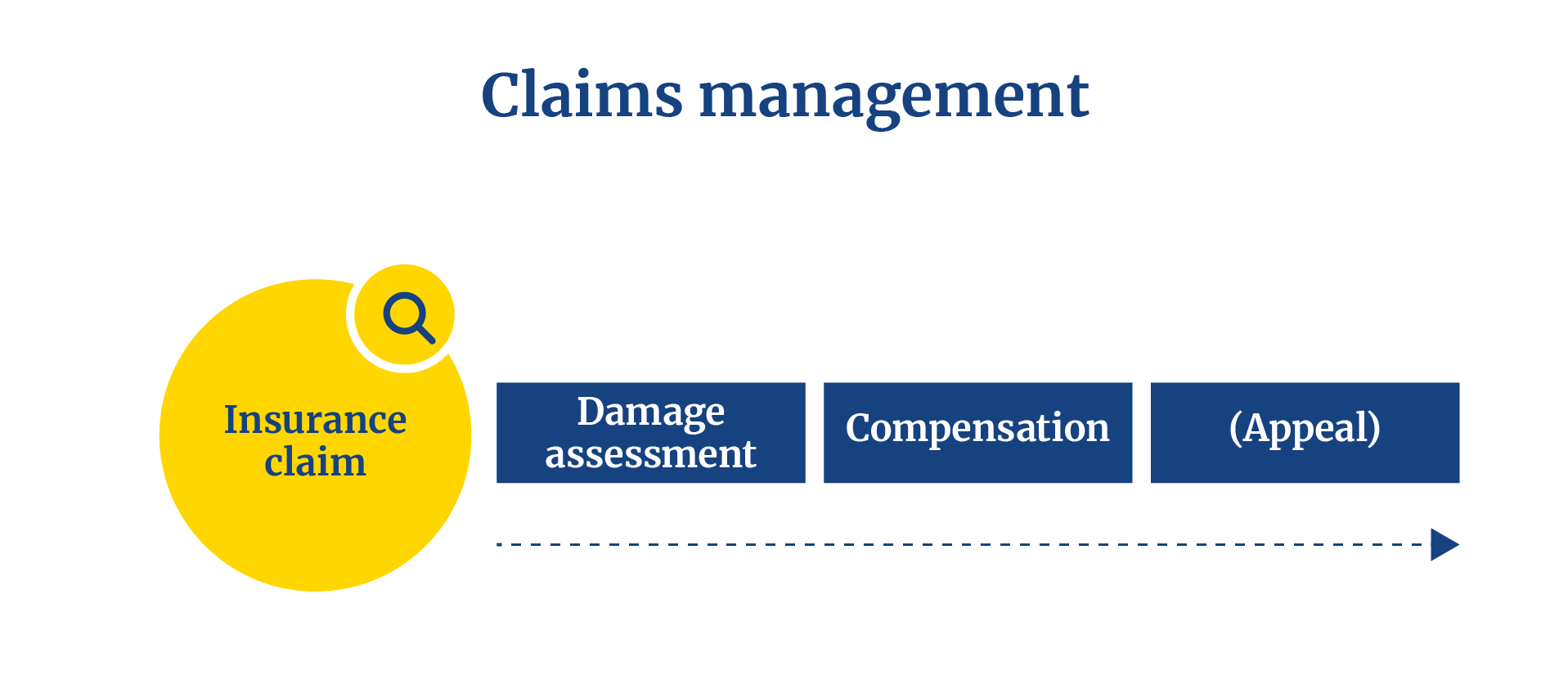

The claims handling process begins when the customer reports a loss by filing a claim notification with the insurance company. In this notification, the customer provides information about the event and their compensation request. It can be submitted in writing, by phone, through an online service, or in person at the insurer’s office. The insurance company records the event and assigns a unique claim reference number for it. Claims are processed by a specialist known as a claims handler.

When filing a claim, the claimant should include a description of the insurance event. This is needed to determine whether the damage is covered and to what extent. The insurer may request additional information from the injured party, the policyholder or the insured person. Official registers, healthcare providers, third-party experts or other insurers may also provide information to support the investigation.

A claim notification must be filed with the insurance company within twelve months of the claimant becoming aware of the insurance event and the resulting damage, and no later than ten years from the original occurrence of the event. This means that if a pipe breakage is discovered fifteen years after it occurred, a claim can no longer be filed, even if the claimant acts immediately upon discovery.

Insurance event refers to loss or damage that entitles the insured to compensation.

Submitting a claim notification is treated the same as submitting a compensation claim. If the request is not submitted within the specified timeframe, the claimant will lose their right to compensation.

Motor Liability Insurance Act and Workers’ Compensation Act

Under the Motor Liability Insurance Act, the claimant must file their compensation claim to the insurer within three years of becoming aware of the insurance event and its consequences. In any case, the claim must be submitted within ten years of the occurrence of the event.

The injured party has the right to request a statement from the Traffic Accident and Patient Injury Board within one year of the insurer’s decision.

Under the Workers’ Compensation Act, a compensation claim or report on an occupational accident must be filed with the insurance institution within one year of the occurrence of the insurance event.

Damage or loss inspection

The extent of the damage is usually not possible to determine solely based on written or verbal reports, especially in the case of substantial property damages. The insurer therefore has the right to inspect the damaged property.

The inspection is carried out either by the insurer’s own loss assessor or an external company the insurer partners with. In the case of vehicle damage, for example, a damaged vehicle may be inspected by the insurance company’s loss assessor or it can be inspected and repaired by a repair shop designated by the insurance company. Correspondingly, in the case of water damage, the moisture survey needed for assessing the damage may be carried out by an external company specified by the insurance company.

When inspecting the damage, the loss assessor will ascertain the nature of the damage and assess the monetary loss. They may also seek to limit the damage or prevent further losses. The injured party must be able to demonstrate that an event that is compensable under the insurance policy has occurred. The insurer may evaluate whether the terms of the policy limit its liability to pay compensation.

Compensation

Once all necessary information has been acquired, the insurer decides whether the event is considered compensable. The decision is based on the agreed insurance cover.

In property damage cases, the amount of compensation may be based on the replacement value, which is the amount required to acquire new property of the same or equivalent type. The decision must be issued to the customer within one month of receiving all relevant information. If the decision is delayed, the customer must be informed of the delay and its reason. The insurer pays interest on delayed compensation in accordance with the Interest Act.

In personal injury cases, compensation may include medical expenses, non-material damages and loss of earnings, depending on the type of insurance and the agreed cover.

In vehicle damage cases, compensation may cover repair costs resulting from a collision or a single-vehicle accident, windscreen damage caused by stone chips, or damage caused by vandalism, depending on the scope of the insurance cover.

Several factors affect both compensability and the amount of compensation. For example, the insured party’s own negligence or false information about the damage may result in denial of compensation. Failure to comply with the insurer’s protection guidelines may reduce the payout. Deductibles and age reductions also typically lower the amount of compensation.

The insurer must issue its claim decision – whether positive or negative – within one month of receiving sufficient information to resolve the matter. The decision must include instructions for appeal.

Good insurance practice requires that the insurance company justifies its claim decisions. The scope of justification depends on the nature and content of the case. The company must justify a decision with special care when the decision is negative or when it deviates from the filed insurance claim.

Appeals

Instructions for appeal are included with the claim decision. Under the Insurance Contracts Act, the time limit for appeal begins when the claimant receives the decision and the appeal instructions. The claimant should first clarify the grounds for the claim decision with the insurance company and, if possible, the employee who handled their case. If the decision is found to be incorrect, it must be rectified without delay. The customer has the right to access documents concerning themselves that form the basis of the decision.

Finnish Financial Ombudsman Bureau (FINE) and the complaints boards

A dissatisfied claimant may seek free advice and guidance from the Finnish Financial Ombudsman Bureau↗ (FINE).

Instead of going to court, disputes concerning insurance compensation may be submitted to various boards, such as the Insurance Complaints Board under FINE or the Consumer Disputes Board under the Finnish Competition and Consumer Authority↗ (KKV). The boards’ decisions are recommendations.

An exception to the above is workers’ compensation insurance, where appeals can only be made to the Accident Appeal Board and escalated to the Insurance Court↗.

Insurance compensation disputes

Disputes concerning insurance compensation may be submitted to the Insurance Complaints Board operating under the Finnish Financial Ombudsman Bureau (FINE). The board handles disagreements related to the interpretation and application of law and insurance terms arising from insurance relationships, brought by the policyholder, the insured person, the injured party, the beneficiary or the insurer.

Private insurance matters may also be submitted to the Consumer Disputes Board, which resolves disputes between consumers and businesses, including those related to insurance services.

Traffic Accident and Patient Injuries Board

To harmonise compensation practices in traffic accident cases, the Traffic Accident and Patient Injuries Board↗ provides statements and recommendations. It also promotes public awareness of traffic accident compensation.

In certain cases, the insurance company is obligated to request a recommended settlement from the Traffic Accident and Patient Injuries Board before making a decision. This is mandatory when the case involves, for example, continuous compensation paid on the basis of permanent loss of income or death or increasing or decreasing the continuous compensation.

Court proceedings

A dissatisfied claimant may bring a compensation dispute before a court. Legal action must be initiated within three years of receiving the written compensation decision and appeal instructions. Processing the dispute in the boards mentioned above does not extend the statutory three-year time limit.

Summary

For the customer, claims are the most important aspect of insurance. While the process may be automated for minor claims, claims handling usually requires further clarification.

The claims handling process begins when the customer reports a loss and submits information about the event to the insurer. Insurance events are identified with a unique claim reference number. The claimant must include a description of the event with their application, and additional information may be requested from various parties. The insurer has the right to inspect the damaged property to determine the cause and extent of the damage.

In property damage cases, compensation may be based on the replacement value. In personal injury cases, compensation may include medical expenses, non-material damages and loss of earnings, depending on the type of insurance and the agreed cover. In vehicle damage cases, compensation may be based on repair costs. Negligence by the insured, false information about the damage or failure to follow protection guidelines may reduce the payout. Deductibles and age reductions also typically lower the amount.

Appeal instructions must be included with the compensation decision. Disputes may be submitted to the Insurance Complaints Board or the Consumer Disputes Board. Traffic accident compensation matters are handled by the Traffic Accident Board. The Finnish Financial Ombudsman Bureau (FINE) provides guidance and support in compensation matters.

Glossary

- Replacement value: The amount of money required to acquire new property of the same or equivalent type.

- Deductible: The agreed amount in the insurance contract that remains the responsibility of the policyholder. The deductible may be a fixed sum or a percentage.

- Insurance Complaints Board: A board operating under the Finnish Financial Ombudsman Bureau (FINE) that handles disputes concerning the interpretation and application of law and insurance terms.

- Consumer Disputes Board: A board operating under the Finnish Competition and Consumer Authority that resolves disputes between consumers and businesses, including those related to insurance policies.

- Traffic Accident and Patient Injuries Board: A statutory board that provides statements and recommendations. In certain cases, the insurer is obligated to request a recommended settlement from the board.