A company’s policy for insurance defines what risks the company chooses to insure and under what scope of coverage. Some risks may deliberately be left uninsured if they are considered so small that the company can bear them on its own. Business insurance covers both fixed assets and current assets (inventories). Oftentimes the insurance also covers third-party property used by the company. In property insurance, the area of validity is usually the insured location, with certain exceptions.

As an employer, the company has certain statutory insurance obligations to its employees. These include statutory pension insurance and occupational accident and disease insurance. The collective agreements of some sectors also require the employer to take out employees’ group life assurance.

Risk management

The purpose of risk management is to minimise losses and operate as cost-effectively as possible. Risk analysis involves analysing the company’s business activities, operating environment, risk management recommendations, assets, personnel and liabilities. By identifying and assessing risks, the company can choose the most appropriate risk management measures.

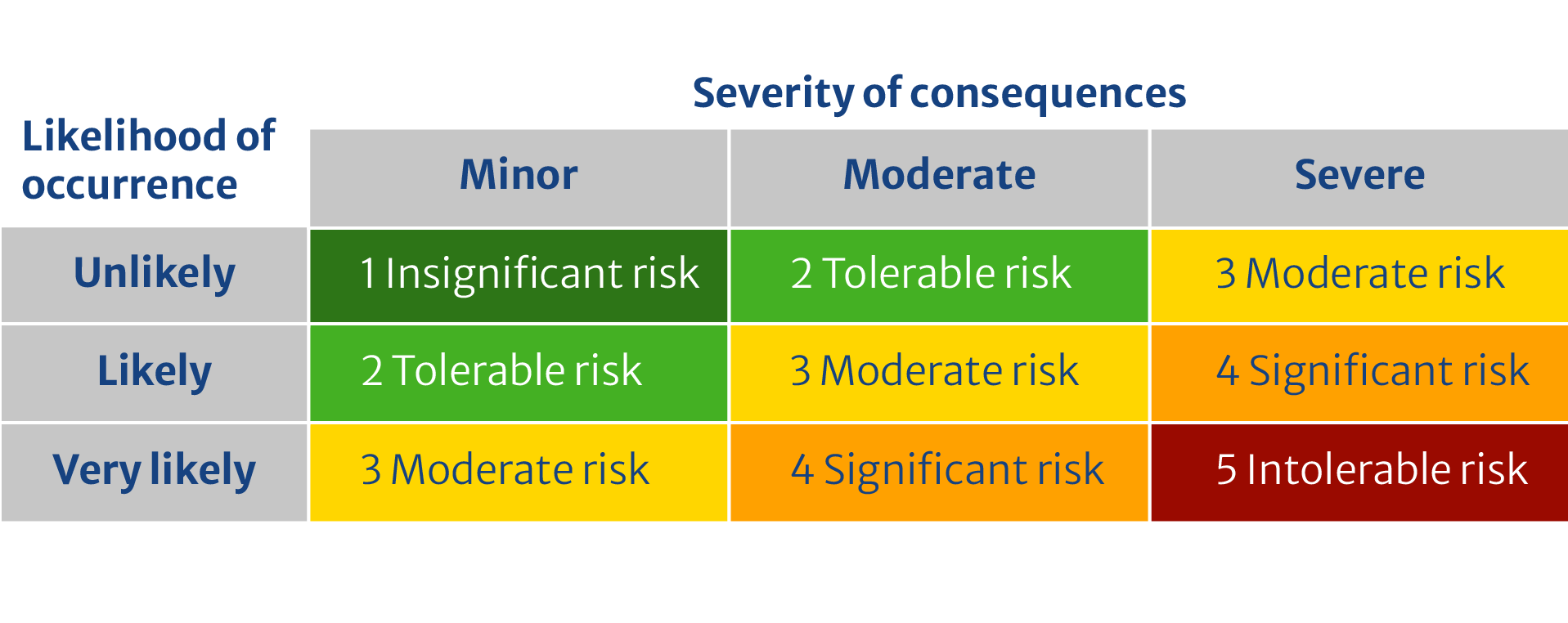

A risk matrix (or risk assessment table), such as the one illustrated below, can be used to determine the level of risk and the appropriate risk management measures. A typical risk matrix visually represents a 3×3 to 5×5 scale of the severity of consequences and the likelihood of occurrence. The level of risk is determined by looking at the intersection of severity and likelihood. The lowest risk value is 1 (insignificant risk) and the highest is 5 (intolerable risk). Insignificant risks can usually be borne without trouble, while significant and intolerable risks require risk reduction measures.

Loss prevention

Loss prevention refers to measures aimed at preventing the occurrence of damage or reducing the damage caused by a loss event. It can be divided into preventative, mitigating and post-damage measures. Insurance companies take the policyholder’s loss prevention measures into account in the policy terms, and certain loss prevention measures may also be a prerequisite for granting insurance. However, ensuring a high level of safety and uninterrupted operations is the most important thing.

Occupational accident and disease insurance

Employers must take out occupational accident and disease insurance for their employees. Companies, private traders and private individuals that employ employees whose combined wages or salaries in a calendar year exceed €1,500 (in 2024) are considered employers. Households that employ workers under an employment contract are also deemed to be employers with a duty to take out insurance.

Work accidents and occupational diseases are compensated under the Workers’ Compensation Act (TyTAL). The act also provides for self-employed persons’ right to obtain insurance against occupational accidents and diseases and leisure-time accidents.

The state has no insurance obligation. However, compensation for occupational accidents or diseases resulting from central government work is paid from state funds as provided in the TyTAL act.

Workers’ Compensation Center (TVK)

The Finnish Workers’ Compensation Center↗ (TVK) co-ordinates and develops the implementation of the Workers’ Compensation Act in Finland. Additionally, TVK processes claims in cases of accident and disease that occur in uninsured work.

Neglect of insurance obligation

Employers that neglect their insurance obligations must pay a fee that corresponds to a reasonable insurance premium for the period of such failure (a payment corresponding to the insurance premium). The fee is imposed by TVK for the current and five previous calendar years. TVK also charges the employer a penalty fee up to three times the amount of the fee corresponding to the insurance premium.

The employee’s insurance coverage is not affected by the employer’s neglect – in the event of an accident, the employee is paid compensation a provided in the TyTAL act. The compensation is recovered from the employer up to a certain limit.

Validity of workers’ compensation insurance

Statutory occupational accident and disease insurance is taken out either as continuous or fixed-term. In continuous insurance, the insurance period is the calendar year, except if the insurance starts in the middle of the year. In that case, the insurance period is from the start date to the end of the following calendar year. The insurance must be valid when work begins, so the application must be submitted well in advance. The insurance comes into effect at the earliest from the date the application is verifiably submitted to the insurance company. The insurance company must provide written confirmation of validity to the policyholder.

Occupational accident insurance premiums

Insurance pricing is based on free competition, and the amount of the insurance premium may vary between companies. Each insurance company defines its own premium principles. These principles form the calculation base that determines how premiums are set and applied. Although they must be applied uniformly to all policyholders, they are not publicly available. While each company establishes its own premium principles, the Workers’ Compensation Act sets out certain rules that all insurers must follow when determining premiums.

Insurance premiums consist of company-specific factors related to the scope of coverage and treatment expenses, as well as a risk premium – in the case of workers’ compensation insurance, this is determined by the risk level associated with the work. In addition, premiums include statutory supplements. These comprise the pay-as-you-go payment, which is used to cover annual index adjustments for continuous compensation, and the labour protection fee, which is allocated to promoting labour protection.

Workers’ compensation insurance premiums are tax-deductible as expenses incurred in earning income. The risk level of the work affects the likelihood of accidents and occupational diseases, and therefore influences the premium: the higher the accident risk, the higher the premium coefficient or premium per mille.

The Workers’ Compensation Center maintains a risk classification of occupational classes for each sector based on compensation statistics. However, this classification is not binding, and individual insurance companies may apply their own risk categories that differ from the Workers’ Compensation Center’s classification.

Unemployment insurance contribution and group life assurance

Unemployment insurance contributions are used to finance costs such as earnings-related unemployment benefits, adult education allowances, pension benefits and Kela benefits. The employee and employer are obliged to make unemployment insurance contributions and they both pay their own shares of them. The payment is made by the employer.

Companies, private traders and private individuals who employ staff and pay them a total of more than €1,500 in wages or salaries during a calendar year are considered employers. As such, they are required to pay unemployment insurance contributions. This obligation applies to employees who are aged 18 or over but under 65.

The unemployment insurance contributions are collected by the Employment Fund↗.

The purpose of employees’ group life assurance is to secure the livelihood of the spouse and children of the insured employee in the event of the employee’s death. The obligation to insure applies to all employers whose binding collective agreement or sector-wide national collective agreement contains provisions on group life insurance.

The employer must take out group life assurance and workers’ compensation insurance from the same insurance company. Compensation claims are processed and paid through the Employees’ Group Life Assurance Pool↗ operating in connection with the Finnish Workers’ Compensation Center.

Voluntary insurance for employees

Employees are a company’s most valuable asset. Voluntary insurance policies are an effective way to engage and motivate key personnel and staff. With supplementary pension insurance, a company can provide additional pension cover either for designated key employees or for a specific group of employees. Voluntary insurance can also be used to prepare for costs arising for example from accidents and illnesses outside of work. Insurance enables employees to access treatment more quickly, which in turn supports a faster return to work. This benefits both the employer and the employee.

Entrepreneur’s insurance

A business often represents an entrepreneur’s life’s work. Self-employed persons bear the risks associated with entrepreneurship and are generally responsible for their own social security. For this reason, it is important for them to prepare for situations such as illness, disability or death by taking out risk insurance policies. One of the advantages of being self-employed is the freedom and responsibility for one’s own actions. However, the downside of this freedom is that entrepreneurs do not have the same automatic benefits as employees, such as comprehensive insurance cover. It is therefore essential to assess the insurance needs of both the entrepreneur and the business to avoid overlaps and to ensure that their overall insurance coverage is sufficient.

Voluntary personal insurance premiums based on an employment relationship are generally tax-deductible for the company. However, they may also influence the entrepreneur’s personal taxation.

Voluntary accident insurance for entrepreneurs

Entrepreneurs are generally not covered by workers’ compensation insurance. Therefore, it is advisable for entrepreneurs to take out voluntary accident insurance, which covers accidents and occupational diseases occurring both during working hours and leisure time. The cover can also be extended to the family members of the insured entrepreneur.

Voluntary pension insurance for entrepreneurs

Entrepreneurs are usually required to take out pension insurance for self-employed persons (YEL) or pension insurance under the Farmers’ Pensions Act (MYEL). If the entrepreneur’s income does not reach the minimum threshold for pension insurance but they satisfy the other requirements for insurance, they can take out pension insurance voluntarily. Voluntary insurance can also be taken out if the entrepreneur is on a state pension and run a business. Voluntary pension insurance can supplement the entrepreneur’s statutory earnings-related pension, which is often considered insufficient for maintaining the desired level of income.

Pension insurance is discussed in more detail in the section on Pensions.

Insurance for company receivables

Credit insurance

Credit insurance protects the company’s trade receivables – one of the most important items on its balance sheet – and shields the company from losses caused by the buyer’s insolvency or unwillingness to pay. It is a risk management tool that enables company management to protect against unexpected political and commercial risks.

As a rule, entrepreneurs and companies should insure their entire portfolio of accounts receivable. However, it is also possible to insure only a specific portion of the trade receivables. This portion can be defined in different ways, for example as domestic sales versus exports, exports to specific countries, sales of a particular product group or sales to the largest customers.

Insurance for company property

The property that a company uses in its operations is known as fixed assets. It can include, for example, machinery, furniture, equipment and production tools.

Property insurance

Property insurance covers buildings, machinery and equipment owned by the company, as well as inventories. However, not all property is covered under property insurance. For instance, motor vehicles and boats are typically insured under their own insurance policies.

When determining the scope of cover, it is essential to consider all of the company’s assets. For each item, attention should be paid to the sum insured, scope of cover, geographical coverage and deductible. Some risks may be left uninsured if the company is both able and willing to bear the risk on its own.

Property is insured at replacement value, which refers to the amount required to acquire new, similar or equivalent property. Buildings are often insured at full value, in which case the insurance is based on the building’s floor area or its volume.

Buildings

Real estate insurance covers the building specified in the policy, as well as technical systems serving the building’s operations, such as heating, water, ventilation, electrical and mechanical systems. However, real estate insurance does not cover technical systems and equipment used in production or business operations conducted within the building.

In addition to the building, real estate insurance often includes structures and equipment not part of the building but owned by the policyholder, such as fences, gates, flagpoles and illuminated signs. There are various types of construction-period insurance policies available for buildings under construction. Insurance can also be taken out for renovation work to cover risks related to repair construction.

Machinery and equipment

Equipment insurance covers furniture (e.g. workshop furniture, office desks and chairs), machinery, equipment and production tools. These can often be insured as a single entity, but in some cases it is necessary to list items separately, for example when dealing with leased equipment or particularly valuable machines.

Insurance for inventories

Goods intended for sale or consumption are considered inventories. Depending on the stage of completion, these may be raw materials, semi-finished products or finished goods.

Like fixed assets, inventories are usually insured at replacement value – that is, the amount required to acquire new, similar or equivalent property. The insurance value of purchased goods is the amount that would have to be paid to acquire them again under normal conditions. The insurance value of self-manufactured semi-finished and finished products is the amount that would be received if they were sold under normal conditions.

Inventories may include:

- Products acquired for resale (in wholesale and retail trade, this typically refers to stock)

- Products to be manufactured, when the company manufactures or further processes products (including raw materials, supplies, semi-finished and finished products)

- Third-party inventories in the company’s possession, such as leased machinery or equipment or customers’ property (e.g. cars, bicycles, machines under repair)

Transport insurance

Goods in transport insurance (also called freight, cargo or logistics insurance) covers the company’s property during transport. It provides financial protection against loss, damage or theft of goods being transported and enables the company to safeguard its business continuity. Transport insurance policies are always tailored to the company, taking into account sales and purchase shipments, import and export shipments, transport between company locations, subcontracting, exhibition shipments and so on.

Transport insurance can be taken out either as continuous insurance or as single-shipment insurance. The price of continuous transport insurance is based on the insured value of the shipments or the company’s turnover. Single-shipment insurance is recommended if the company only transports goods occasionally.

Company liability and legal expenses insurance

Entrepreneurs may face various claims for compensation, for example when customers are dissatisfied with the quality of work. An entrepreneur may also be held legally liable for an incident or for damage caused by a sold product, and harm caused to others may lead to significant claims for damages. Delivery contracts used in business-to-business transactions can have a significant impact on the amount of compensation the company may be required to pay. Liability insurance can cover damages based on applicable law.

Company liability insurance

The most common liability insurance policies cover property damage and personal injury. However, there are also liability insurance policies that cover financial losses caused to third parties. All insurance policies include limitations. For example, a policy may exclude the cost of redoing or correcting defective or incomplete work (so-called “faulty workmanship”). Another common exclusion is damage to property under the policyholder’s care or control, or damage caused intentionally or through gross negligence. Depending on the industry, insurers may offer additional terms that extend the coverage. The most common liability insurance policies are general liability insurance and product liability insurance.

Company legal expenses insurance

Legal expenses insurance helps companies cover necessary and reasonable legal expenses and litigation costs arising from the use of legal assistance in civil and criminal cases. It is also useful in contractual disputes and may also cover disputes concerning the quality of work. This insurance is suitable for almost all industries and companies operating in Finland.

Under the legal expenses insurance, a claim is considered to have occurred when a formal dispute has arisen or the insured has been served with a summons. The grounds for the dispute must have emerged while the insurance was valid. Therefore, entrepreneurs are strongly advised to take out the insurance when setting up a company – even before its business operations begin.

Legal expenses insurance often includes a limitation stating that costs awarded to the adverse party are not covered. Similarly, costs related to disputes concerning intangible rights, such as patents, are generally not covered. The product offering of individual insurance companies may vary, however.

Business interruption insurance

Business interruption insurance protects a company’s operating result if operations are halted or disrupted due to sudden and unforeseeable property damage. The insurance covers lost gross profit (contribution margin), variable wages, and costs incurred in limiting the interruption during the damage period. The cause of the interruption may be property damage at the company’s own premises, such as a fire or machinery breakdown.

Key person insurance

The entrepreneur’s ability to work is the foundation of the company’s operations, especially in small businesses. Illness or accident can affect anyone. In addition to the entrepreneur, the company may have other key employees whose disability could be critical in a business where replacing them is difficult or even impossible. Insurance companies offer solutions for situations caused by such personnel interruptions.

Suppliers’ extension

A company’s operations may also be interrupted due to property damage suffered by a contractual partner. Suppliers’ extension can cover the risk of interruption caused by property damage affecting a direct business customer or subcontractor.

Epidemic interruption

Authorities may impose restrictions or bans on business operations under the Communicable Diseases Act or the Animal Diseases Act. Epidemic interruption insurance is essential in industries that handle foodstuffs, such as the food industry and restaurant services.

Summary

An insurable risk must be financially assessable, sudden and unforeseeable, and its probability and frequency must be measurable. In addition, a large number of entities must be exposed to the same risk. The objective of risk management is to identify and assess risks and to select the most appropriate risk management methods.

Motor insurance is a statutory form of cover that compensates for personal injuries sustained by all parties involved in an accident, as well as for material damage suffered by the innocent party.

Statutory employee insurances for employers include earnings-related pension insurance, accident insurance and unemployment insurance contributions. In certain sectors, employers are also required to take out employees’ group life assurance.

Entrepreneurs are responsible for arranging their own insurance cover. A company may insure its receivables, fixed assets, movable property, cash and securities, and inventories. Other common types of business insurance include liability insurance, business interruption insurance and legal expenses insurance.