The growth of savings and investments largely depends on how funds are divided between fixed-income investments and equity investments. Fixed-income or interest-bearing investments are typically considered safer, but their returns are usually more modest. The most familiar forms are savings accounts and fixed-term deposits offered by banks. As with any asset class, the return and risk level vary between different types of fixed-income products. Fixed-income instruments are typically chosen to preserve capital and generate steady, moderate income. Investments in shares, on the other hand, are used to pursue higher returns, since both theory and experience suggest that in the long run shares are the most profitable option. However, investing in shares also means accepting the risk of losing part – or in the worst case, all – of the invested capital. The right balance between fixed-income investments and equity investments depends on each investor’s risk tolerance and their planned investment horizon.

Investing can be done either actively or passively. Passive investing means following a predefined approach, most commonly through index funds that automatically track the composition of a chosen index. Because decisions are made mechanically, this approach is inexpensive and well suited as part of a diversified portfolio. Active investing, by contrast, involves analysing and selecting investments in line with a specific strategy, with the aim of achieving better returns and/or lower risk.

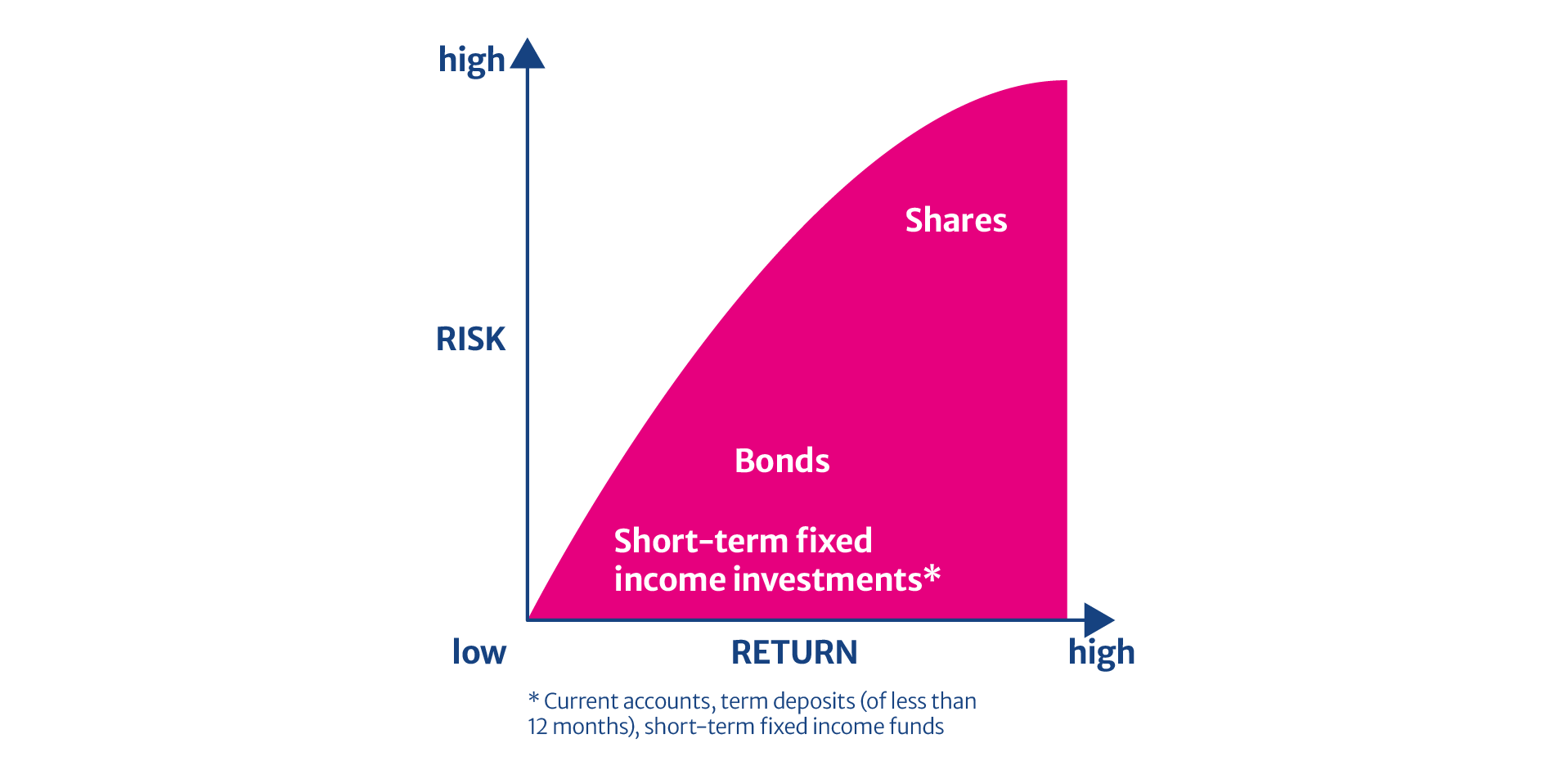

Risk and return go hand in hand: a higher expected return is only possible if you take on more risk. Put simply: the greater the return you aim for, the more uncertainty you must accept. Risk is commonly defined as the uncertainty of future returns. There is no such thing as a high-yield, risk-free investment.

Portfolio diversification

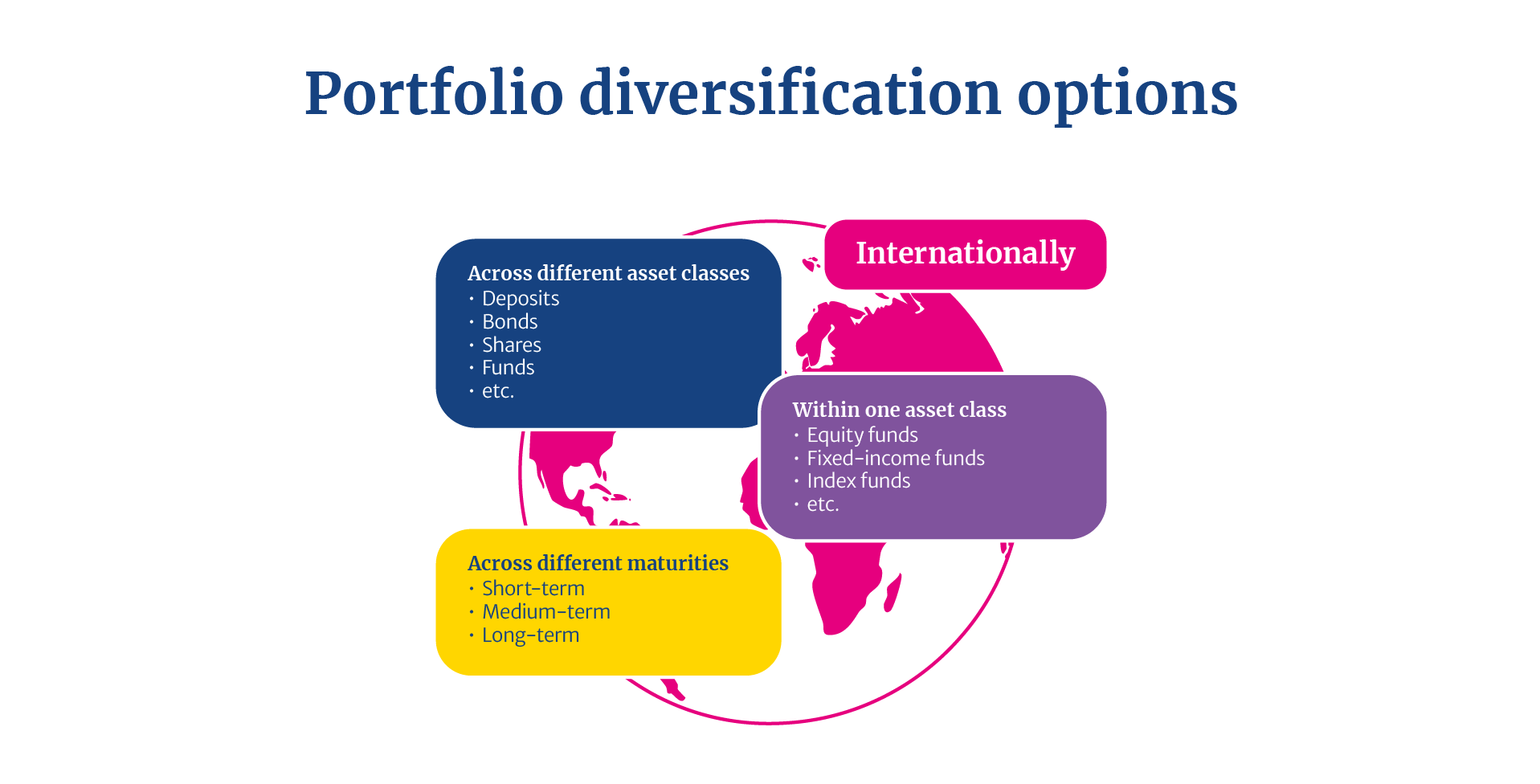

In a well-diversified portfolio, gains in some investments can offset losses in others, so that one setback does not derail the entire portfolio. Diversification means spreading assets across investments that are not closely correlated and that carry different risks.

Portfolio diversification can be easily achieved by investing in different asset classes, such as fixed-income instruments, commodities, shares, properties or forest assets. Investors can significantly reduce fluctuations in portfolio value by effectively diversifying among asset classes. Investment funds offer good options for cost-effective diversification and portfolio construction. Investing in just a few well-chosen funds can already provide broad diversification. Every investor should pay attention to effective diversification.

An “asset class” refers to a category of investment, such as shares, commodities, fixed-income products or real estate.

It is also important to diversify investments over time, for example by investing regularly in both good and bad market conditions. This improves financial resilience against economic cycles and inflation.

EU regulation (MiFID II and MiFIR)

The regulation on markets in financial instruments is largely based on the MiFID II Directive and the MiFIR Regulation. Together, they constitute a comprehensive set of rules aimed at improving investor protection and increasing transparency of trading activity.

Under MiFID II, investment service providers are required to classify their clients and to gather sufficient information about their knowledge, experience, financial situation and investment objectives. The purpose is to ensure a higher level of investor protection. If a client does not provide the necessary information, the provider cannot offer personalised investment advice.

In addition to client protection, the rules cover trading in financial instruments and the licensing and organisational requirements for companies offering investment services. They steer trading towards regulated venues, improve transparency and support fairer, more open markets. The regulation applies, where relevant, not only to investment firms but also to market operators, including the trading venues they run, central counterparties and reporting service providers.

In short, the overall goal of MiFID II and MiFIR is to act in the best interests of investors: investment service providers are better informed to recommend suitable products, and markets as a whole become more open and transparent.

Savings and investment plan

Saving and investing become easier and more effective when you have first clarified what you want to do and why. Drawing up a savings and investment plan is an important step when starting out. A good plan should outline your current wealth, set out the goals of your saving or investing and define your personal tolerance for risk. These goals will play a major role in determining which investment products and targets are suitable. Since circumstances change, it is advisable to revisit the plan over time – for example when starting a family, when income rises or falls or when moving into retirement.

A wide range of information about investing is available from books, magazines, online sources and other services. The Finnish Foundation for Share Promotion promotes the interests of both investors and companies by publishing various statistics and guides. Further up-to-date materials, instructions, publications and advice are available from the Finnish Financial Ombudsman Bureau (FINE), which assists in matters related to insurance, banking and securities.