Simply put, the core function of banks is to accept deposits and grant loans to both personal and corporate clients. In this way, savings from households and other entities are channelled into investments. Additionally, banks provide payment services as well as investment and wealth management services. Banks also actively operate in money and capital markets, buying, selling, and brokering various financial instruments. Deposit banks hold a unique position, as only they are authorised to accept public deposits. Assets deposited in Finland are automatically protected by a statutory deposit guarantee scheme. All deposit-taking banks are required to contribute to the Deposit Guarantee Fund.

In Finland, banks play a significant role in household housing finance, with housing finance primarily handled through banks or mortgage institutions. Banks and other credit institutions grant loans directly to households or housing companies. In many other countries, mortgage institutions play an even greater role in financing home purchases. Their funding is arranged through bond markets. The reasons for different systems lie in regulatory frameworks and historical developments. In addition to housing loans, banks also grant households consumer credit and student loans.

Bank revenue and expenses

Banks’ most significant and stable source of income is net interest income – the difference between interest income and interest expenses. Net interest income is primarily influenced by the interest margin, which is the difference between banks’ lending and deposit rates. Although net interest income remains the most significant source of income for banks, the gap between other (non-interest) income and net interest income has narrowed considerably. Banks make other income from payment services, service charges and fees, securities trading, currency exchange and guarantee operations.

Loan interest rates closely follow changes in market interest rates, as most bank loans are tied to short-term reference rates such as Euribor and prime rates. Deposit rates, however, do not respond as quickly to general interest rate changes, as a significant portion of deposit rates are fixed.

Banks’ other income includes capital gains from selling securities, which can lead to significant fluctuations in the income from one year to another. The role of fee and commission income has become more significant as banks generate more revenue from payment services, lending, securities operations and asset management.

A bank uses its income to finance its operations, provide returns to shareholders and cover credit losses. Wages and social insurance contributions account for about half of expenses. Other expenses include costs related to cash management, IT, and marketing.

As business has grown, so have bank expenses. Investments driven by digitalisation have contributed to this growth. Finnish banks’ efficiency, measured by their cost-to-income ratio, has nevertheless remained at a good level even by international standards.

Banking operations

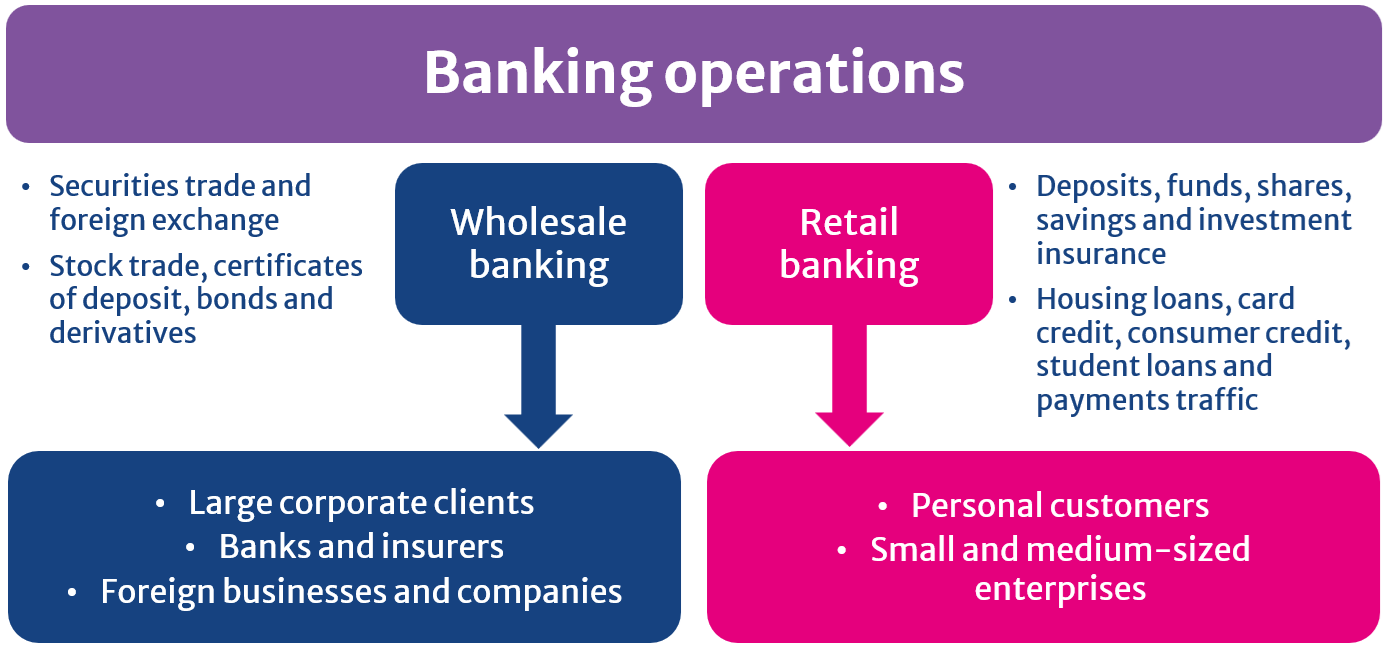

Banking operations are traditionally divided into two segments: retail banking and wholesale banking.

Retail banking

Retail banking generally refers to the handling of payment, deposit, credit and custody needs of relatively small businesses and households. In a sense, these activities are the backbone of banking. Retail banking has, however, diversified significantly, moving beyond the traditional deposit and lending services.

Wholesale banking

Wholesale banking involves trading in domestic and foreign money and securities markets. Interbank markets for short-term financial claims, for example, are an essential part of wholesale banking operations. Activities related to securities issuance, trading and corporate finance under the name of investment banking also fall under wholesale banking.

Development of banking in Finland

The development of banking in Finland can be divided into six discrete eras:

- The pre-war period up to 1914

- The beginning of money market regulation in 1939

- Financial market liberalisation in the 1980s (relaxation of lending and loan rates)

- The Finnish banking crisis in the early 1990s

- Adoption of the EU’s single currency (accounting currency in 1999, cash in 2002)

- The global financial crisis in 2008 and the subsequent European sovereign debt crisis

Banking has also been transformed by technological developments, particularly the rapid growth and adoption of online banking services and mobile payments. An increasing share of banking activities such as bill payments, securities trading and loan applications are handled online on a home computer or through mobile services. The volume of electronic transactions has grown significantly. Banking has also been affected by increased competition, the financial crisis, and changes in customer needs and behaviour. Population ageing is changing service needs and increasing demand for saving and investment services. The financial crisis has led to increased regulation and tighter supervision, which in turn raise banks’ costs in many areas.

First banks

The first savings banks in Finland were established in the 1820s. Cooperative banking began in 1902 with the founding of the Central Lending Fund of the Cooperative Societies (OKO) followed by the first cooperative banks. Cooperative societies became cooperative banks in 1970 following changes in banking legislation. The first mortgage institution was the Finnish Mortgage Society, founded in the 1860s. The savings bank system and cooperative banking movement were particularly important in the monetisation of society, i.e. the transition from a barter economy to a money economy. The first commercial bank was Suomen Yhdys-Pankki (SYP), founded in 1862. Its strong competitor was Kansallis-Osake-Pankki (KOP), founded in 1889. SYP and KOP later merged and today are part of the Nordea Group. Another notable bank was Postisäästöpankki, founded in 1887. Postisäästöpankki became the first Finnish company to enter the computer age in 1958.

Market liberalisation and mergers

With the liberalisation of financial markets in the 1980s, new players entered the market, including foreign banks and new domestic entities such as banks and brokerage firms. After the banking crisis, the early 1990s were marked by a sharp reduction in the number of bank branches and staff. After this significant reduction, the number of branches and staff has remained relatively level during the 2020s.

Mergers and alliances have reshaped the Finnish banking sector

Banks and insurance companies have sought new forms of cooperation. Banking and insurance groups have formed financial conglomerates or amalgamations, and banking groups have expanded their operations into various areas of finance and investment, sometimes beyond traditional banking.

Other functions of banks

Banks continue to play a significant role in corporate financing, despite large companies increasingly using international financing and capital markets alongside domestic bank financing. Banks manage corporate bond issuance on behalf of the companies. Some banks also offer investment and wealth management services. As investment options diversify and wealth grows, banks’ investment and wealth management services have expanded.

Some banks also offer other investment services besides deposit services, such as insurance and mutual fund savings. These services are provided either through companies within the bank’s group or by brokering products from other investment firms. The provision of risk management services is another key function of banks alongside financing and payment transmission. In addition to traditional custody services, this includes products that protect against interest rate and currency risks or help customers hone their risk diversification strategies.