Shares

Part of a limited liability company’s equity consists of share capital, which they raise by issuing shares. Shares are individual units that form the company’s stock. When a company lists on a stock exchange, its shares are given a market price and can be traded. When an investor purchases shares in the company, this is called equity investment.

Shares can be grouped into many categories. On stock exchanges, companies are most commonly classified into around ten main sectors (e.g. financials, information technology). At the broadest level, shares are usually divided into growth and value stocks.

Investing in foreign shares

When investing in foreign shares, such as American stocks, it is important to take into account the exchange rate between the dollar and the euro. Currency movements are a major factor influencing portfolio returns when investing outside the euro area. If the investment is denominated in a foreign currency, that currency is just as significant to the outcome as the return potential of the investment itself. Factoring currency fluctuations into investment decisions requires an understanding of the cause-and-effect relationships at play in the markets.

Types of stocks

Growth stocks are characterised by rapid revenue growth and often by strong price volatility. Growth companies typically reinvest their profits, which means that dividend payouts are usually rare and lower than average. The return from growth stocks thus comes primarily from capital appreciation.

Value stocks, on the other hand, are from more stable, established companies operating in sectors where strong growth prospects are unlikely. They are priced much lower and tend to hold their value better in a declining market. A key feature of value stocks is their strong ability to pay dividends.

Sources of return on equities

The returns on equity investments come from both dividends and capital appreciation. A positive trend in share prices is linked to factors such as the companies’ growth prospects, operational improvements and, ultimately, profit growth.

Dividends represent a company’s decision to distribute part of its profits to shareholders. The decision to pay dividends is made at the annual general meeting. Most listed companies pay dividends once a year, typically in the spring, with the dividends paid directly into shareholders’ bank accounts. Some companies, however, choose to distribute dividends several times a year.

Debt securities

Bonds

A bond is a loan issued by a company, government, municipality, credit institution or organisation and sold to investors. Bonds are debt instruments through which the issuer borrows money from the investor.

Each bond has an issue date (start date) and a maturity date, meaning the issuer borrows money from investors for a fixed period of time.

Interest on bonds

The issuer pays the investor interest during the loan period and repays the nominal principal at maturity. The interest rate, also known as the coupon, may be fixed (e.g. 3.00%) or variable (e.g. 3-month Euribor + 0.50%).

Denominations

The total loan amount is divided into units that investors can purchase or subscribe to. A unit represents the minimum tradable or subscribable amount of the loan. For standard bonds, the minimum unit is usually €1,000.

Bond yield

The yield on a bond consists mainly of interest payments. Coupons are usually paid once a year, and the nominal principal is repaid at maturity together with the final interest payment. When a bond is issued, both the nominal interest rate and the effective yield are disclosed. The effective yield takes into account the issue price (the subscription price) and shows the actual return the investor will receive.

Estimated yield may also rise or fall if the bond is sold before maturity. Transaction costs reduce the yield, and if market interest rates rise, the bond’s market value may fall below its nominal value. However, if the bond is held to maturity and was not issued above par (over 100), there is no risk of capital loss.

Index-linked bonds

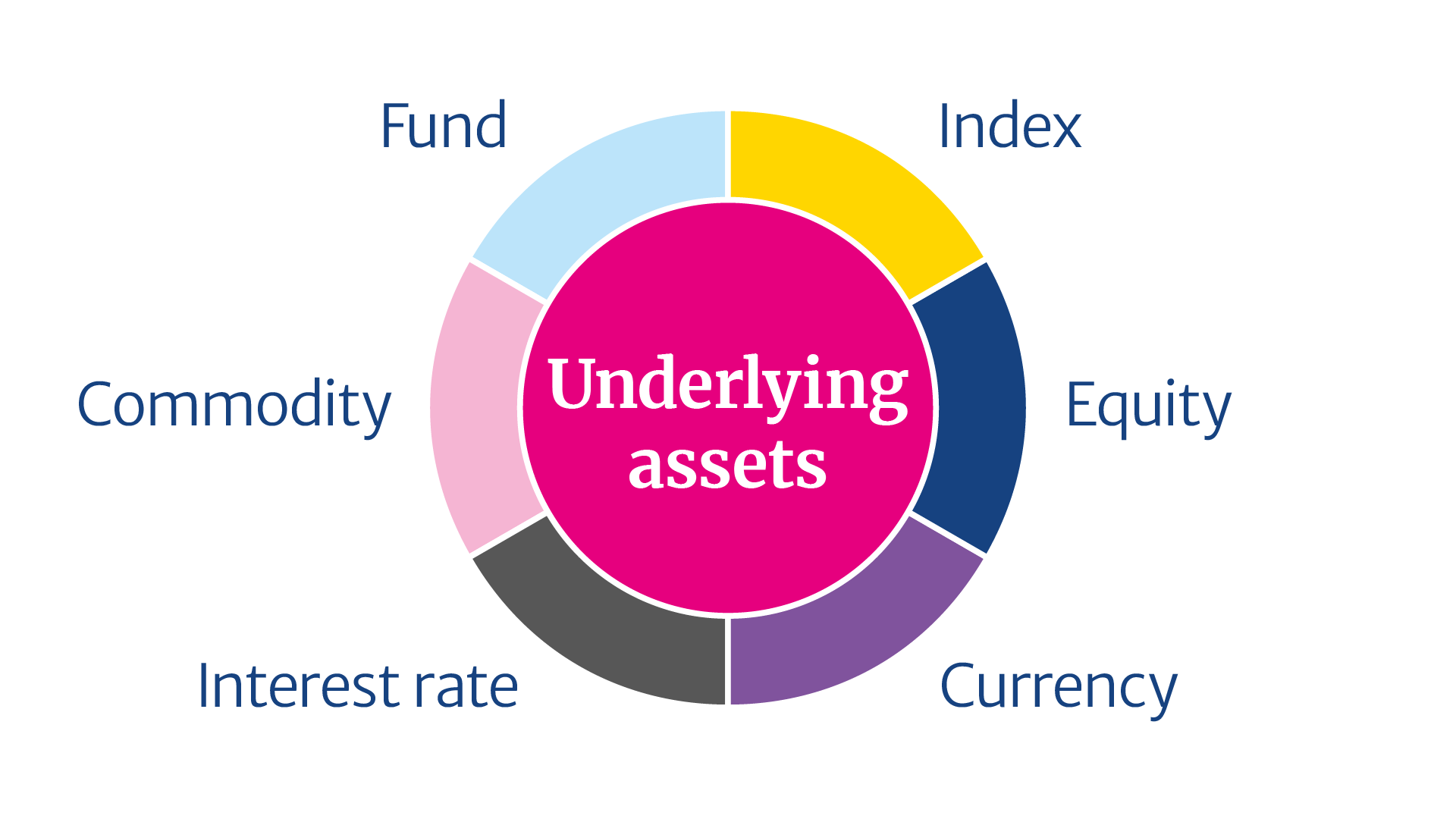

Index-linked bonds are bonds whose yield is linked to the performance of an underlying asset or index. Unlike ordinary bonds, they do not pay regular interest. Instead, the investor receives an index-linked return based on the change in the underlying index, as specified in the bond terms. The amount of this return depends on two factors: the participation rate (or multiplier) set out in the terms, and the change in the underlying asset’s value between the start and the end of the bond. The participation rate indicates the proportion of the investor’s share of the underlying asset’s value change (for example 70–100%).

Capital protection

Capital protection means that the issuer guarantees to repay the investor at least the nominal principal at maturity. This protection is secured through a fixed-income investment that runs for the entire term of the bond. On the issue date, a deposit is placed at the prevailing market interest rate so that, by the maturity date, the invested principal plus interest equals the nominal value of the bond.